- Visit the Bullion Center

- Getting Started

-

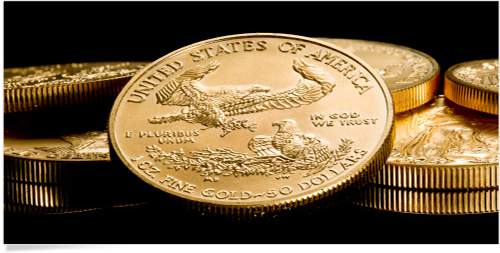

Gold & Silver

-

More on Gold & Silver

- Gold & Silver Market Reports

- Infographics

-

- Bullion Glossary

- FAQs

Looking to invest in gold and other precious metals but not sure how to get started? This APMEX article will help you learn.

Start by downloading the New Investors Guide. It’s full of detailed information about investing in precious metals and will give you a solid foundation on the basic principles of bullion investing. The APMEX Guide for New Investors gives you concise insights and quick-start facts on what you need to know to start investing in precious metals. Best of all, it’s free!