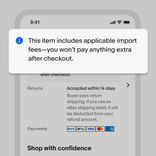

Total price includes fees

The item price reflects import fees. Nothing else is due later.

Check back here for updates as we learn about changes to US tariffs and Customs policy.

If you purchase any item that ships from outside the US, you will need to pay import fees. We’ll show if import fees apply on the item page and at checkout.

See if any applicable import fees are included at checkout. If not, you may be able to calculate a rough estimate of duties you might owe.

If import fees are not included in the price or collected at checkout, your shipping carrier will request payment on delivery.

Watch out for fake customs or delivery fee requests. Scammers may impersonate carriers (e.g. DHL, FedEx, UPS).

Find more information about shipping providers, US Customs, and more.

Find definitions for key terms.

Tariffs: A tax on goods imported from foreign countries paid by the buyer. These are generally based on the type of good, value, and quantity.

Import fees or duties: A broader term for fees charged on imported goods, which typically includes tariffs and other fees.

Import: Bringing goods into a country from another country.

De minimis: Defines the limit below which imported goods won’t need to be charged duties and taxes. (Note: US de minimis will be suspended globally, effective August 29, 2025, meaning all shipments to the US–regardless of value–may be subject to duties and customs clearance).

Country/Region of Manufacture (country of origin): The country or territory where the finished item was manufactured, produced, or grown–not where it ships from. This is used to determine duties, taxes, and import fees.

Yes, you’re covered by eBay Money Back Guarantee if you’ve paid import fees and your item doesn’t arrive, is delayed due to customs processing, or arrives not as described. However, if you refuse the package because of import fees or shipping carrier charges, eBay Money Back Guarantee does not apply.

There’s no change to our order cancellation policy. Keep in mind, sellers aren’t required to accept cancellations due to unexpected import fees, customs requirements, or delivery charges from shipping carriers.

We’re keeping updated on any circumstances that affect your expected delivery date. However, there may be unexpected delays beyond our or the seller’s control.

We recommend tracking your order’s delivery status through your Purchase History, where we’ll share the latest information on your estimated delivery date. If the seller is using a tracked service, you’ll see the item’s tracking number as a link next to the item.

Please check eBay help pages in your country.